It seems like anything you watch on the news now days, is always related to COVID19 (Corona Virus). We are currently going through unprecedented times the closest pandemic event being compared to the Spanish flu of 1918.

The Canadian government deserves to be recognized for their efforts to help Canada control and ‘flatten the curve’. A lot of misinformation is being circulated on social media and WhatsApp messages so we wanted to take this opportunity to explain the new changes the Government is bringing into affect.

Major announcements:

Prime minister Trudeau and our Finance minister Bill Morneau have announced a very comprehensive plan. A few of the major announcements were the following:

Canada Child Benefit will increase by $550/per family on average to help parents with young children.

Emergency Care benefit – for workers up to $900 every 2 weeks that need to stay home and don’t qualify for EI benefits.

Emergency support benefit – Government will support workers financially who do not qualify for EI and are facing unemployment related to COVID19.

For Low income Canadians, In May the GST credit will be increased up to $300 and up to $150 per child.

Student loans will have 6 months interest free pause on repayments.

Boosting funding for women’s shelters and those experiencing homelessness

Canadian Banks will be more flexible for delays on mortgage payments and other credit bills for up to 6 months. This is on a case by case basis so you should reach out to your bank.

Taxes will be delayed until June 1st for Personal taxes to file your taxes and taxes won’t be due until August 2020 to make payments.

Temporary wage subsidy – eligible for small businesses, 10% of wages for three months, to help employers keep their workers on the payroll. Not for profits and charities are included.

Small businesses will be supported with Business Credit availability program

EMPLOYEES: Changes to Employment Insurance (EI)

With increasing concerns over employment insurance (EI) sick leave benefits, the government has made some adjustments to contend with the COVID-19 outbreak and resulting quarantine and self-isolation.

Normally a worker with little or no paid benefits through an employer who becomes injured or ill can apply for up to 15 weeks of employment insurance. After a one-week waiting period, the benefits begin. So, if you break your leg and can’t work for two weeks, you will get paid for one week of lost work.

Employed Canadians who pay EI premiums, including self-employed who have registered to participate, qualify for the benefit. The criteria includes a loss of at least 40% of usual weekly pay and workers who have worked a minimum of 600 hours in the prior year. Self-employed individuals have a 12-month waiting period prior to their ability to file a claim.

Qualifying for Benefits

For individuals quarantined because of COVID-19, the waiting period is waived. So, you can receive benefits for the entire two weeks you are quarantined.

A doctor’s medical certificate is waived for patients in quarantine by law or order of a public health official. This includes those who are asked to self-isolate under the recommendations published and requested by the employer.

If you are quarantined only as a precaution and are not diagnosed at that time, but later test positive for COVID-19, you will be able to receive EI benefits for the additional isolation period with signed medical documentation.

The current benefit for EI sick leave is 55% of earnings to a maximum payment of $573 per week.

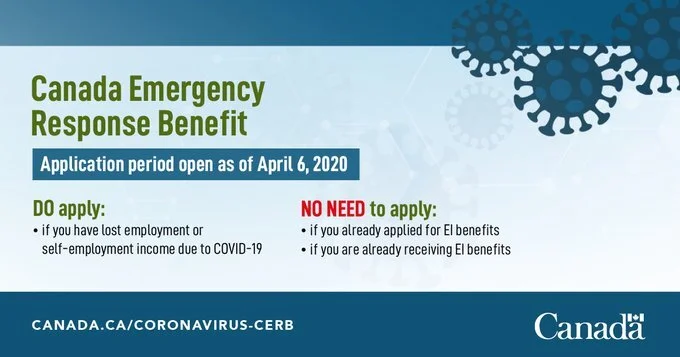

For Canadians not eligible for EI benefits, the government is looking toward alternatives to provide for the loss of income from quarantine and isolation.

BUSINESS OWNERS: Temporary wage subsidy

Business owners I really feel for you right now. If you want to discuss business continuity strategy please reach out to me and I am more than willing to help you in any way or form.

Cash is king and with small business owners being forced to close shop (Restaurants etc) cash will soon start to dry up. The Canadian banks are giving more flexible terms on providing credit so you can apply to BDC (Business Development Center) where business loans will be provided to keep liquidity flowing in your business.

Taxes are probably the last thing on your mind right now and I don’t blame you. The Finance minister has authorized for all taxes payments to be delayed to August 2020 and although Corporate taxes are still due June 30th the taxes owing are not due until August 2020.

There is a temporary wage subsidy being provided to small businesses which is 10% of employee’s wages for 3 months to help employers keep their workers on payroll. If you do the math taking $40,000 average salary divided by 12 months = $3333.33 month * 3 months = $10,000 * 10% = $1000 wage subsidy. Although this is not really going to help to keep employees on payroll some relief is better than nothing so we welcome this for small business owners.

Small business owners will be supported with business credit availability program. If you need to get loans arranged please let me know and we can get those organized for you!

Continuing Efforts

Remember that all of this is in the beginning phases and will continue to evolve as the situation changes. Documentation, processes, and other requirements are being developed. The government is making significant efforts to reduce the difficulties for those persons who are quarantined.

It is estimated that waiving the waiting period will cost the government $5 million. The final cost will depend on the extent of the outbreak.

It is important to remain informed of your benefits during this period. It is equally critical to remain calm and to distinguish between official statements and rumors.

Final Thoughts:

Please stay safe and practice Social Distancing. If you need any help related to business continuity and overall just cash flow planning please reach out. This is a completely free service to help small business owners like yourself. We are here to help you so please reach out.

Contact your Accountants today click on this link —> https://capexcpa.com/contact

Links:

https://www.canada.ca/en/department-finance/news/2020/03/canadas-covid-19-economic-response-plan-support-for-canadians-and-businesses.html

https://toronto.citynews.ca/2020/03/18/morneau-canada-money-coronavirus-covid/

- The Capex Team